!Корпоративное право 2023-2024 / 2013-study-analysis_en

.pdf

|

|

part of the |

3) The prohibition |

corporate |

|

|

||

|

|

company’s regular |

only applies to |

opportunities, but |

|

|

||

|

|

activities and no |

opportunities of |

according to some |

|

|

||

|

|

special benefit is |

which the director |

Portuguese |

|

|

||

|

|

granted to the |

becomes aware |

commentators the |

|

|

||

|

|

director |

while performing |

prohibition of |

|

|

||

|

|

|

his functions; |

using corporate |

|

|

||

|

|

|

opportunities |

opportunities is |

|

|

||

|

|

|

offered to the |

also applicable to |

|

|

||

|

|

|

director in a |

directors who |

|

|

||

|

|

|

personal capacity |

have resigned |

|

|

||

|

|

|

are excluded |

from office in |

|

|

||

|

|

|

|

|

|

order to exploit a |

|

|

|

|

|

|

|

|

specific existing |

|

|

|

|

|

|

|

|

opportunity |

|

|

|

|

|

|

|

|

|||

Romania |

1) Art. 144(3): |

1) Corporate |

No statutory |

Duty of |

|

|||

|

|

a) If directors (or a |

opportunities |

regulation or case |

confidentiality, Art. |

|

||

|

|

doctrine |

law |

144(1) |

|

|||

|

|

member of their |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

family) have a |

Scope: unclear, |

|

|

|

||

|

|

personal interest |

as no explicit |

|

|

|

||

|

|

in a transaction |

statutory |

|

|

|

||

|

|

with the company, |

regulation and no |

|

|

|

||

|

|

they must disclose |

case exist |

|

|

|

||

|

|

the conflict of |

2) Duty not to |

|

|

|

||

|

|

interest to the |

|

|

|

|||

|

|

compete with the |

|

|

|

|||

|

|

board and to the |

|

|

|

|||

|

|

company, Art. |

|

|

|

|||

|

|

internal auditors, |

|

|

|

|||

|

|

153 |

11 |

|

|

|

|

|

|

|

and refrain from |

|

|

|

|

|

|

|

|

- Competing |

|

|

|

|||

|

|

participating in the |

|

|

|

|||

|

|

companies: |

|

|

|

|||

|

|

decision on the |

|

|

|

|||

|

|

“companies |

|

|

|

|||

|

|

transaction |

|

|

|

|||

|

|

pursuing the same |

|

|

|

|||

|

|

b) If the disclosure |

|

|

|

|||

|

|

type of activity” |

|

|

|

|||

|

|

obligation is not |

|

|

|

|||

|

|

- The provision |

|

|

|

|||

|

|

complied with: the |

|

|

|

|||

|

|

refers only to |

|

|

|

|||

|

|

interested |

|

|

|

|||

|

|

executive |

|

|

|

|||

|

|

transaction |

|

|

|

|||

|

|

directors and |

|

|

|

|||

|

|

remains valid, but |

|

|

|

|||

|

|

managers; non- |

|

|

|

|||

|

|

has to pass the |

|

|

|

|||

|

|

executive |

|

|

|

|||

|

|

test of fairness in |

|

|

|

|||

|

|

members of the |

|

|

|

|||

|

|

a court of law |

|

|

|

|||

|

|

board are not |

|

|

|

|||

|

|

c) These |

|

|

|

|||

|

|

bound by a |

|

|

|

|||

|

|

obligations do not |

|

|

|

|||

|

|

statutory duty, but |

|

|

|

|||

|

|

apply to |

|

|

|

|||

|

|

they may be |

|

|

|

|||

|

|

transactions in the |

|

|

|

|||

|

|

subject to a |

|

|

|

|||

|

|

ordinary course of |

|

|

|

|||

|

|

contractual |

|

|

|

|||

|

|

business |

|

|

|

|||

|

|

obligation not to |

|

|

|

|||

|

|

|

|

|

|

|||

|

|

2) Art. 144(4): |

compete |

|

|

|

||

|

|

prohibition of the |

- No case law |

|

|

|

||

|

|

provision of any |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

financial |

|

|

|

|

|

|

|

|

advantages, |

|

|

|

|

|

|

|

|

loans, guarantees |

|

|

|

|

|

|

|

|

etc. by the |

|

|

|

|

|

|

|

|

company to the |

|

|

|

|

|

|

|

|

directors |

|

|

|

|

|

|

|

|

3) Art. 150: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

141 |

Directors’ Duties and Liability in the EU |

|||

|

|

transactions of the |

|

|

|

|

|

|

|

director with the |

|

|

|

|

|

|

|

company involving |

|

|

|

|

|

|

|

assets amounting |

|

|

|

|

|

|

|

to more than 10% |

|

|

|

|

|

|

|

of net assets |

|

|

|

|

|

|

|

require approval |

|

|

|

|

|

|

|

by the GM |

|

|

|

|

|

|

|

|

|

|

|

||

Slovakia |

s. 196a: directors |

1) No business |

- The duty of |

1) Duty of |

|

||

|

|

(and related |

opportunity |

confidentiality |

confidentiality, s. |

|

|

|

|

persons) shall not |

doctrine, only the |

continues to apply |

194(5) |

|

|

|

|

be granted credit |

general duty of |

after resignation, |

2) Duty to act in |

|

|

|

|

or a loan by the |

loyalty applies: |

which may apply |

|

||

|

|

good faith, s. |

|

||||

|

|

company; have |

directors shall not |

where the director |

|

||

|

|

194(7) |

|

||||

|

|

company property |

pursue a business |

exploits company |

|

||

|

|

|

|

||||

|

|

transferred to |

opportunity if this |

information for the |

|

|

|

|

|

them or provided |

conflicts with the |

benefit of another |

|

|

|

|

|

for their use; or a |

interests of the |

party |

|

|

|

|

|

liability secured by |

company |

- The decision to |

|

|

|

|

|

the company, |

|

|

|

|

|

|

|

2) Duty of non- |

resign in order to |

|

|

||

|

|

unless the |

|

|

|||

|

|

competition, s. |

take advantage of |

|

|

||

|

|

supervisory board |

|

|

|||

|

|

196: directors |

a business |

|

|

||

|

|

gives its prior |

|

|

|||

|

|

must not: |

opportunity may |

|

|

||

|

|

consent and the |

|

|

|||

|

|

a) enter into |

be a breach of the |

|

|

||

|

|

transaction is |

|

|

|||

|

|

duty of loyalty, but |

|

|

|||

|

|

transactions that |

|

|

|||

|

|

conducted on an |

|

|

|||

|

|

no case law on |

|

|

|||

|

|

|

|

|

|

||

|

|

arms’ length basis |

are related to the |

|

|

||

|

|

this point |

|

|

|||

|

|

|

company’s |

|

|

||

|

|

|

|

|

|

||

|

|

|

business activity |

|

|

|

|

|

|

|

b) mediate the |

|

|

|

|

|

|

|

company’s |

|

|

|

|

|

|

|

business |

|

|

|

|

|

|

|

arrangements for |

|

|

|

|

|

|

|

other parties |

|

|

|

|

|

|

|

c) participate as a |

|

|

|

|

|

|

|

shareholder or |

|

|

|

|

|

|

|

member with |

|

|

|

|

|

|

|

unlimited liability |

|

|

|

|

|

|

|

in another |

|

|

|

|

|

|

|

company pursuing |

|

|

|

|

|

|

|

a similar business |

|

|

|

|

|

|

|

activity |

|

|

|

|

|

|

|

d) be a manager |

|

|

|

|

|

|

|

or director of |

|

|

|

|

|

|

|

another company |

|

|

|

|

|

|

|

pursuing a similar |

|

|

|

|

|

|

|

business activity |

|

|

|

|

|

|

|

|

|

|

||

Slovenia |

Regulation of |

1) Duty of non- |

The ban on |

Duty of |

|

||

|

|

related party |

competition, Art. |

competition may |

confidentiality, Art. |

|

|

|

|

transactions, Art. |

41(1): members of |

continue after the |

263(1) |

|

|

|

|

38a: |

the management |

end of the |

|

|

|

|

|

1) Transactions |

board and the |

director’s term of |

|

|

|

|

|

supervisory board |

office |

|

|

||

|

|

with another |

|

|

|||

|

|

may not |

|

|

|

||

|

|

company in which |

|

|

|

||

|

|

participate as |

|

|

|

||

|

|

a director (or a |

|

|

|

||

|

|

director or |

|

|

|

||

|

|

family member) |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

142 |

Directors’ Duties and Liability in the EU |

|||

|

|

holds at least 10% |

employee in |

|

|

|

|

|

|

of the share |

another company, |

|

|

|

|

|

|

capital, is member |

or pursue as |

|

|

|

|

|

|

of a dormant |

entrepreneur an |

|

|

|

|

|

|

company, or |

activity that is or |

|

|

|

|

|

|

participates in any |

could be in |

|

|

|

|

|

|

other way in the |

competition with |

|

|

|

|

|

|

profits, require the |

the activity of the |

|

|

|

|

|

|

consent of the |

company |

|

|

|

|

|

|

supervisory board |

2) A member of |

|

|

|

|

|

|

(or the GM if the |

|

|

|

||

|

|

the management |

|

|

|

||

|

|

company does not |

|

|

|

||

|

|

board may not |

|

|

|

||

|

|

have a |

|

|

|

||

|

|

pursue an activity |

|

|

|

||

|

|

supervisory |

|

|

|

||

|

|

with a view to |

|

|

|

||

|

|

board) |

|

|

|

||

|

|

profit in the area |

|

|

|

||

|

|

|

|

|

|

||

|

|

2) If the director |

of the company’s |

|

|

|

|

|

|

(or family |

activity without the |

|

|

|

|

|

|

member) holds |

consent of the |

|

|

|

|

|

|

less than 10%: the |

supervisory board, |

|

|

|

|

|

|

directors must |

Art. 271 |

|

|

|

|

|

|

notify the |

3) The general |

|

|

|

|

|

|

supervisory board |

|

|

|

||

|

|

duty of loyalty can |

|

|

|

||

|

|

within three |

|

|

|

||

|

|

be interpreted as |

|

|

|

||

|

|

working days |

|

|

|

||

|

|

prohibiting the |

|

|

|

||

|

|

|

|

|

|

||

|

|

|

exploitation of |

|

|

|

|

|

|

|

corporate |

|

|

|

|

|

|

|

opportunities, but |

|

|

|

|

|

|

|

no case law since |

|

|

|

|

|

|

|

the duty was |

|

|

|

|

|

|

|

introduced very |

|

|

|

|

|

|

|

recently (2012) |

|

|

|

|

|

|

|

|

|

|

||

Spain |

- s. 229: self- |

s. 228: directors |

1) Duty of secrecy |

Non-competition, |

|

||

|

|

dealing is |

are prohibited |

(s. 232) continues |

s. 230: |

|

|

|

|

permitted if the |

from exploiting |

after resignation. |

authorisation of |

|

|

|

|

director: |

corporate |

Legal literature: it |

the GM required |

|

|

|

|

|

opportunities if: |

|

|

||

|

|

1) informs the |

ends when the |

|

|

||

|

|

|

|

|

|

||

|

|

board of directors |

1) they have |

consequences of |

|

|

|

|

|

of the conflict |

become aware of |

disclosure are no |

|

|

|

|

|

2) abstains from |

the opportunity by |

longer detrimental |

|

|

|

|

|

reason of their |

to the company or |

|

|

||

|

|

any decisions |

|

|

|||

|

|

position |

the information |

|

|

||

|

|

relating to the self- |

|

|

|||

|

|

|

|

can be disclosed |

|

|

|

|

|

dealing |

2) the company |

|

|

||

|

|

|

|

|

|||

|

|

transaction |

has an interest in |

2) Some case law |

|

|

|

|

|

(Note: the |

the opportunity (it |

exists that has |

|

|

|

|

|

falls within the |

held resigning |

|

|

||

|

|

provisions is wide |

|

|

|||

|

|

company’s line of |

directors liable for |

|

|

||

|

|

and encompasses |

|

|

|||

|

|

business) and has |

the exploitation of |

|

|

||

|

|

not only self- |

|

|

|||

|

|

not ruled out the |

corporate |

|

|

||

|

|

dealing, but any |

|

|

|||

|

|

investment. |

opportunities |

|

|

||

|

|

conflict of interest, |

|

|

|||

|

|

|

|

(Supreme Court, 2 |

|

|

|

|

|

e.g. affecting |

The director must |

|

|

||

|

|

September 2012, |

|

|

|||

|

|

internal decision- |

communicate the |

|

|

||

|

|

RJ/2012/9007) |

|

|

|||

|

|

making |

conflicting |

|

|

||

|

|

|

|

|

|||

|

|

processes) |

situation to the |

|

|

|

|

|

|

- In addition, |

company; the |

|

|

|

|

|

|

company can |

|

|

|

||

|

|

transactions can |

|

|

|

||

|

|

authorize the |

|

|

|

||

|

|

be challenged on |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

143 |

Directors’ Duties and Liability in the EU |

|||

|

the ground that |

transaction (the |

|

|

|

they are unfair, |

conflicted director |

|

|

|

i.e. not in the best |

must abstain) |

|

|

|

interest of the |

|

|

|

|

company |

|

|

|

|

|

|

|

|

Sweden |

1) Ch. 7, § 46: |

No binding |

The duties no |

No statutory rule |

|

shareholder may |

regulation, the |

longer apply when |

regarding |

|

not vote in respect |

general duty of |

a director resigns. |

confidentiality in |

|

of the following |

loyalty may apply. |

However, |

the Companies |

|

matters: |

Directors have a |

according to some |

Act, but the |

|

a) legal |

duty to pursue |

scholars, directors |

general duty of |

|

corporate |

who set up a |

loyalty provides |

|

|

proceedings |

|||

|

opportunities on |

competing |

that the director |

|

|

against them |

|||

|

behalf of the |

business, take |

may not reveal |

|

|

b) their discharge |

|||

|

company. |

advantage of |

information that |

|

|

from liability in |

|||

|

|

business secrets |

may jeopardise |

|

|

damages or other |

|

||

|

|

of the company |

the company’s |

|

|

obligations |

|

||

|

|

and/or of |

interests. |

|

|

towards the |

|

||

|

|

corporate |

|

|

|

company |

|

|

|

|

|

opportunities, can |

|

|

|

|

|

|

|

|

c) legal |

|

be found liable for |

|

|

proceedings or a |

|

breach of the |

|

|

discharge in |

|

general duty of |

|

|

respect of another |

|

loyalty. |

|

|

person, where the |

|

|

|

|

shareholder |

|

|

|

|

possesses a |

|

|

|

|

material interest |

|

|

|

|

which may conflict |

|

|

|

|

with the interests |

|

|

|

|

of the company |

|

|

|

|

2) Ch. 8, § 23: |

|

|

|

|

directors may not |

|

|

|

|

participate in a |

|

|

|

|

matter regarding: |

|

|

|

|

a) agreements |

|

|

|

|

between the |

|

|

|

|

board member |

|

|

|

|

and the company |

|

|

|

|

b) agreements |

|

|

|

|

between the |

|

|

|

|

company and a |

|

|

|

|

third party, where |

|

|

|

|

the board member |

|

|

|

|

in question has a |

|

|

|

|

material interest |

|

|

|

|

which may conflict |

|

|

|

|

with the interests |

|

|

|

|

of the company |

|

|

|

|

c) agreements |

|

|

|

|

between the |

|

|

|

|

company and a |

|

|

|

|

legal person |

|

|

|

|

which the board |

|

|

|

|

member is entitled |

|

|

|

|

to represent |

|

|

|

|

|

|

|

|

144 Directors’ Duties and Liability in the EU

|

d) litigation and |

|

|

|

|

other legal |

|

|

|

|

proceedings are |

|

|

|

|

equated with |

|

|

|

|

agreements within |

|

|

|

|

the meaning of |

|

|

|

|

the preceding |

|

|

|

|

paragraphs |

|

|

|

|

|

|

|

|

United Kingdom |

1) s. 177: the |

s. 175(2): |

s. 170(2)(a): the |

1) Duty to act in |

|

director declares |

1) Exploitation of |

duty not to exploit |

accordance with |

|

the nature and |

corporate |

the company’s |

|

|

any property, |

|||

|

extent of his |

opportunities |

constitution and |

|

|

information or |

|||

|

interest to the |

continues after |

proper purpose |

|

|

opportunity |

|||

|

other directors |

resignation. |

doctrine, s. 171 |

|

|

2) The company |

|||

|

before the |

Old case law: |

2) Duty to |

|

|

does not need to |

|||

|

company enters |

|||

|

maturing business |

promote the |

||

|

be able to make |

|||

|

into the |

|||

|

opportunities |

success of the |

||

|

use of the |

|||

|

transaction. (note |

|||

|

doctrine → |

company, s. 172 |

||

|

opportunity |

|||

|

that some |

|||

|

directors are liable |

|

||

|

|

3) Duty to |

||

|

transactions |

3) Line of |

||

|

if they resign in |

|||

|

exercise |

|||

|

require members’ |

business test |

||

|

order to take up |

|||

|

independent |

|||

|

approval, ss. 188- |

applied by older |

||

|

the opportunity or |

|||

|

judgment, s. 173 |

|||

|

225); the |

case law, but see |

||

|

use special |

|||

|

|

|||

|

interested director |

O’Donnell v |

4) General duty to |

|

|

knowledge of a |

|||

|

does not have to |

Shanahan [2009] |

avoid conflicts of |

|

|

business |

|||

|

abstain from |

B.C.C. 822: an |

interest, s. 175(1) |

|

|

opportunity or |

|||

|

voting (but see |

opportunity falling |

|

|

|

trade secrets (as |

5) Duty not to |

||

|

Art. 16 Model |

outside the scope |

||

|

opposed to |

accept benefits |

||

|

Articles for Public |

of business of the |

||

|

general know-how |

from third parties, |

||

|

Companies: the |

company may |

||

|

acquired in the |

s. 176 |

||

|

director is not to |

nevertheless give |

||

|

course of their |

|

||

|

be counted as |

rise to the |

|

|

|

employment) |

|

||

|

participating in the |

prohibitions of the |

|

|

|

|

|

||

|

meeting for |

corporate |

|

|

|

quorum or voting |

opportunities |

|

|

|

purposes) |

doctrine |

|

|

|

2) Ex ante |

|

|

|

|

authorisation by |

|

|

|

|

shareholders, s. |

|

|

|

|

180(4)(a) |

|

|

|

|

3) Ex post |

|

|

|

|

ratification by |

|

|

|

|

shareholders , s. |

|

|

|

|

239 (the |

|

|

|

|

interested director |

|

|

|

|

cannot vote) |

|

|

|

|

|

|

|

|

145 Directors’ Duties and Liability in the EU

Discussion

Related party transactions

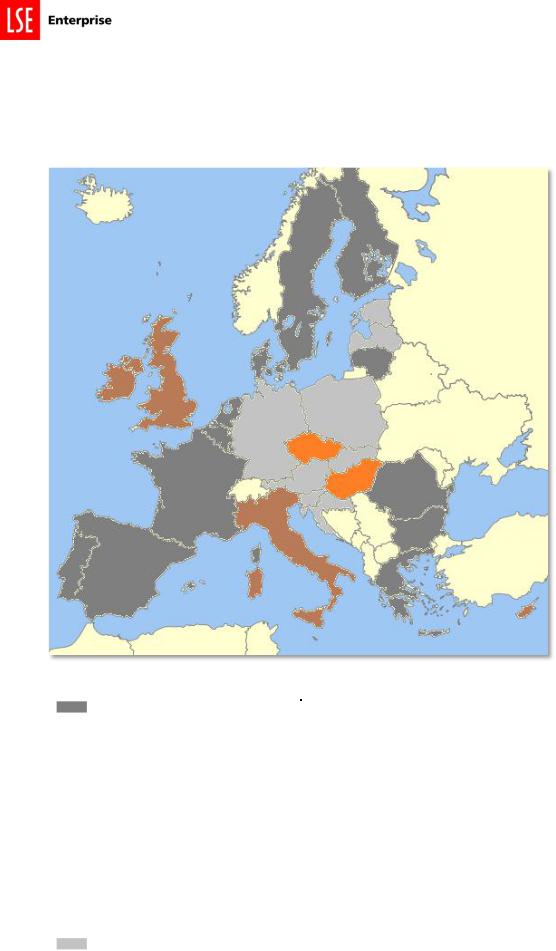

Map 2.5.2.a: Related party transactions

|

Legend |

|

Country |

|

|

|

|

|

|

|

The country applies a broad |

|

BE, BG, DK, FI, FR, EL, LT, LU, NL, |

|

|

rule to conflicted transactions |

|

PT, RO, ES, SE |

|

|

that makes all or the most |

|

|

|

|

important such transactions |

|

|

|

|

(exempting, for example, |

|

|

|

|

transactions in the ordinary |

|

|

|

|

course of business) conditional |

|

|

|

|

upon disclosure and a decision |

|

|

|

|

by a disinterested organ (i.e. the |

|

|

|

|

conflicted director cannot |

|

|

|

|

participate in the decision that |

|

|

|

|

authorises the interested |

|

|

|

|

transaction) |

|

|

|

|

|

|

|

|

|

The country uses the two-tier |

|

AT, EE, DE, HR, LV, PL, SK, SI |

|

|

board system and allocates |

|

|

|

|

decision-making power for |

|

|

|

|

|

|

|

|

|

|

|

|

|

146 |

|

Directors’ Duties and Liability in the EU |

||

transactions between the |

|

company and the director to the |

|

supervisory board |

|

|

|

The country makes all or the |

CY, IE, IT, MT, UK |

most important conflicted |

|

transactions conditional upon |

|

disclosure, but the interested |

|

director can participate in the |

|

decision that authorises the |

|

interested transaction |

|

|

|

Fragmentary regulation |

CZ, HU |

|

|

As is to be expected, the regulatory landscape follows largely the distribution of the one-tier and twotier models in the EU. Two countries that offer formally a choice between the one-tier and two-tier systems are included in the group of countries with a mandatory two-tier board structure: Croatia, where the unitary board system has only recently been introduced (2007) and has no tradition in company law, and Slovenia, where the majority of companies opt for the two-tier system. Hungary would also fall into this category, given that the choice between the one-tier and two-tier model only dates back to 2006 and most companies have a supervisory board, but the law does not use the existence of the supervisory board to reallocate decision-making power.155

Two-tier versus one tier board system: The two-tier board system is less flexible than a broadly defined and generally applicable no-conflict rule. In two-tier board systems, the law simply re-allocates decision-making power (to a supervisory organ with regard to transactions between the company and a member of the management organ),156 but it does not impose a duty on directors to avoid any kind of conflict of interest. This has the consequence that particular questions are left unregulated, for example the problem of who decides on a transaction that is not formally between the company and the director, but in which the director is interested. A good example is a contract between the director’s company and another company in which the director is a substantial shareholder. In some countries, for example Germany, the management board would continue to have the power to represent the company in such a transaction.157

However, this does not apply to all two-tier board systems. Slovenian law, for examples, specifically provides that the authorisation by the supervisory board is required where the director (or a family member) holds 10% or more of the share capital, is a silent partner, or participates in any other way in the profits of the other undertaking. If the holding amounts to less than 10%, the director must still notify the supervisory board within three working days.

Alternative tests: French law allows an interested transaction (other than those entered into in the ordinary course of business) if it was authorised by the board, with the interested director abstaining from voting, the transaction has no prejudicial consequences for the company, or it is approved by the general meeting.

Intermediate cases: Ambivalent cases are Cyprus, Ireland, Malta, and the United Kingdom. The company law does not prohibit interested directors from participating and voting in the board meeting that decides on the interested transaction, but good practice (and the model articles of association that apply if the company does not adopt alternative articles) require the director to abstain from voting. In addition, in the UK, companies with a premium listing on the London Stock Exchange are subject to additional requirements.158 The Listing Rules promulgated by the UK Listing Authority (UKLA) require

155See the discussion below ‘Fragmentary regulation’.

156See, for example, German Stock Corporation Act, § 112.

157OLG Saabrücken, AG 2001, 483.

158Companies listed on the Main Market of the London Stock Exchange can choose between premium and standard listing. Premium listing involves the most stringent standards of regulation with rules that are partly super-equivalent, i.e. that go beyond the requirements imposed by EU law.

147 Directors’ Duties and Liability in the EU

such companies to disclose related party transactions to their shareholders and obtain shareholder approval for the transaction.159 Related party transactions are defined as transactions between the company and, among others, a director, shadow director, or substantial shareholder of the company.160 Exceptions apply to small transactions and a number of other enumerated transactions.161 Importantly, the interested director is not allowed to vote on the resolution approving the related party transaction.162 In spite of these qualifications, we assign the intermediate cases to group 3 because the rules preventing the interested director from participating in the decision regarding the self-dealing transaction do not stem from binding company law and are limited in their scope.

As regards Belgian law, it should be noted that a distinction is drawn between private companies and companies that have issued shares to the public (including listed companies). The general rule is that the conflicted director does not have to abstain from participating in the decision approving the related party transaction, unless the articles of association provide otherwise. However, the rules are more stringent if the company has issued shares to the public. The Companies Act requires directors of such companies not to participate in the proceedings of the board or vote on the matter.163

Fragmentary regulation: In the Czech Republic, the law only regulates a limited number of specifically defined interested transactions, namely credit or loan contracts with the directors, contracts securing the debts of directors, free-of-charge transfers of property from the company to directors, and transfers of assets for consideration exceeding 10% of the company’s capital. In Hungary, the law does not contain any specific rules on related party transactions in the public company (in private companies, authorisation of the general meeting is required). Therefore, it is necessary to take recourse to general principles of civil law, notably the law on representation and agency. According to agency law, the agent is prohibited from contracting with himor herself or from acting if the other party is also represented by the agent. While a supervisory board exists in many companies, the law does not reallocate decision-making power to that board where the company engages in related-party transactions. The supervisory board is not expected to represent the company and act on behalf of it, either in general or in this specific situation. These rules are commonly regarded as being unsatisfactory.

Netherlands: The law in force until December 2012 regulated conflicts of interest as a matter of representation, i.e. the interested director lacked authority to represent the company, with the consequence that a conflicted transaction was not valid in relation to third parties that contracted with the director’s company. These rules were widely criticised as leading to legal uncertainty and were reformed by the Management and Supervision Law, which entered into force on January 1, 2013. The new regime no longer relies on corporate representation, but introduces a bright-line prohibition of directors who have a direct or indirect interest in a transaction to participate in the decision-making process regarding that transaction. If as a result of the prohibition no board resolution can be passed, the supervisory board will be entrusted with the decision (or, if a supervisory board does not exist, the general meeting, unless provided for otherwise in the articles of association).

Corporate opportunities

Corporate opportunities can be defined as business opportunities in which the corporation has an interest. The effectiveness of the regulation of corporate opportunities thus depends on two factors. First, is the exploitation of corporate opportunities by the directors for their own account restricted and, if yes, under which conditions (disclosure, disinterested approval, etc.) are the directors free to pursue a business opportunity that belongs to the corporation? Second, how is it determined when a business

159Listing Rules, LR 11.1.7R.

160LR 11.1.4R. Substantial shareholders are holders of 10% or more of the company’s voting rights (LR 11.1.4AR).

161Threshold ratios for small and smaller transactions are 0.25% and 5% of the company’s value, respectively. Small transactions are exempted from the rules and for smaller transactions modified requirements apply. See LR 11.1.6R, LR 11.1.10R, LR 11 Annex 1 R.

162LR 11.1.7R(4).

163Companies Code, Art. 523 § 1, 4.

148 Directors’ Duties and Liability in the EU

opportunity ‘belongs’ to the corporation? With respect to both dimensions, the law may adopt a narrow approach (i.e., the regulation is applicable to a narrowly defined set of cases) or a broad approach

(applicable to a wide range of directors’ activities). It could be said that the narrow approach imposes a smaller risk of liability on directors and facilitates the realisation of business opportunities, which may contribute to an efficient allocation of resources, while the broad approach ensures a more comprehensive protection of shareholders. For example, as far as the first dimension is concerned, the law may only address direct conflicts of interest, i.e. where the director himor herself exploits a corporate opportunity (narrow approach), but not indirect conflicts created by the activities of a company or other business association in which the director has an interest (broad approach). As far as the second dimension is concerned, the law may define the necessary link between the business opportunity and the company narrowly, requiring the opportunity to fall within the line of business actually pursued by the company (or at least identified as one of the company’s objects in the articles of association), or broadly, capturing for example any type of economic activity and disregarding the capacity of the company (financial or otherwise) to make use of the opportunity.

The Member States employ two general strategies to regulate corporate opportunities. One group of countries (in particular, those belonging to the common law) impose a fairly broad duty on directors not to exploit any information or opportunity of the company, as this would constitute a case of a prohibited conflict of interest, and a second, larger group relies on the duty not to compete with the company. No country establishes an absolute prohibition. All jurisdictions allow directors to exploit corporate opportunities after authorisation by the board of directors, supervisory board, or general meeting of shareholders, as applicable.

Furthermore, in most jurisdictions the rules apply both to direct conflict cases (the director himor herself takes advantage of the opportunity) and indirect conflicts (the director is involved in a business that engages in activities that are potentially or actually of economic interest to the company). The legal systems differ in details, for example with respect to the question of when the interest of the director in a competing business is significant enough to trigger the prohibitions of the no-conflict or non-compete rule or when the activities of a person affiliated with the director implicate the director himor herself. But all legal systems that regulate these conflicts (which is not the case for all jurisdictions analysed) provide for some mechanism that goes beyond the purely formal directorcompany relationship and includes affiliates that are economically identical or closely related to the director.164

The Member States differ systematically with regard to the second dimension: the definition of the necessary link between the business opportunity and the company. Interestingly, the difference correlates with the regulatory strategy employed by the legal system: the duty not to exploit corporate opportunities on the one hand, or the prohibition to compete with the company on the other hand. If the jurisdiction adopts the former strategy, the duty generally encompasses all cases of an actual or potential conflict, i.e. the director is prohibited from exploiting the business opportunity notwithstanding the company’s current activities or financial means. The non-compete rule, on the other hand, is generally interpreted narrowly. ‘Competing with the company’ is understood as pursuing an economic activity within the scope of the company’s business, i.e. engaging in actual, not only potential, competition with the company.

However, it is not clear that this correlation lies in the nature of the regulatory strategy adopted. Essentially, this is a simple matter of how the boundaries of the no-conflict and non-compete duties are defined and interpreted. For example, Portugal’s company law contains a codified version of the non-compete duty.165 In addition, it is argued that an unwritten corporate opportunities doctrine exists that applies if the business opportunity falls within the company’s scope of activity or the company has expressed an interest in the opportunity and received a contractual proposal or is in negotiations.166

164For details see Table 2.5.2.a and the country reports.

165Portuguese Code of Commercial Companies, Art. 398(3).

166Jorge Manuel Coutinho de Abreu, Deveres de cuidado e de lealdade dos admnistradores e interesse social, in Reformas do Código das Sociedades (N.º 3 da Colecção, Almedina 2007), 17, 26-27.

149 Directors’ Duties and Liability in the EU

Thus, the definition of “corporate opportunity” is narrower than the one developed by, for example, the English courts. In this manner, the corporate opportunities doctrine and the codified duty not to compete with the company are aligned. On the other hand, under the heading ‘prohibition of competition’, Austria and Germany prohibit directors from operating any other business enterprise, notwithstanding its line of business.167 Nevertheless, it may be argued that the structure of the corporate opportunities doctrine as found in common law jurisdictions is more conducive to an openended, flexible interpretation, given that it is based on a broadly understood requirement to avoid conflicts of interest of any kind, whereas the use of the term ‘competition’ implies a proximity of the prohibited activity and the company’s business. On this view, the differences in the scope of the prohibition would be a natural consequence of the different legal strategies initially adopted.

On the basis of the foregoing considerations, we divide the Member States in Map 2.5.2.b below into the following groups.

(1)The broad approach is based on what can be called the ‘no-conflict rule’: Directors are required to avoid any type of conflict of interest with the company, which means in this context that they must refrain from exploiting business opportunities. As explained, the legal systems that employ this approach define the term ‘corporate opportunity’ broadly, encompassing any business opportunity that is actually or potentially of economic interest to the company. The prohibition does not only apply if the company has expressed an interest in the opportunity or it can be assumed that such an interest exists because of the close link with the company’s current operations. The theoretical possibility of a (future) overlap with the company’s activities is sufficient. In addition, the financial capacity of the company to exploit the opportunity is irrelevant.

(2)The narrow approach relies on the duty not to compete with the company. The director is generally168 only required to refrain from pursuing economic activity in the company’s line of business.

(3)Finally, the third group comprises jurisdictions that do not contain any binding regulation of corporate opportunities, either by way of a statutory no-conflict or non-compete provision or a well-established case-law based corporate opportunities doctrine.

167Austrian Stock Corporation Act, § 79(1); German Stock Corporation Act, § 88(1).

168For a more detailed discussion see below.

150 Directors’ Duties and Liability in the EU